26 Jul 2017 Italian pension funds increase their strategic allocation to alternatives

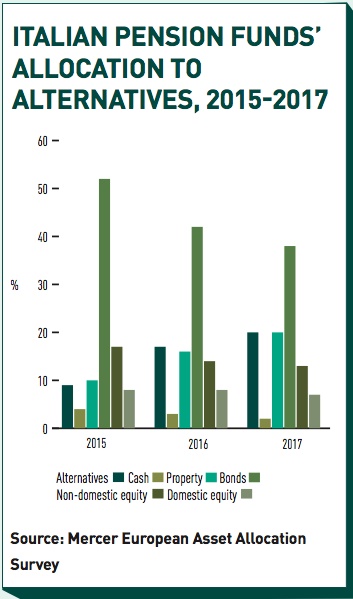

Investment and Pensions Europe (IPE) reports that Italian pension funds, large and small, have all increased their strategic allocations to alternatives, from 10% in 2014 to 20% in 2016. Investing in Alternatives matters for pension fund members, who have their savings invested in less correlated asset classes and the general economy.

Due to a lack of decorrelation and capital protection, some schemes have cut their allocations to funds of hedge funds and now study how to achieve better diversification with a portfolio of Alternative UCITS funds.