09 Jun 2017 LuxHedge May 2017 Alternative UCITS Newsletter: 8% market growth since January

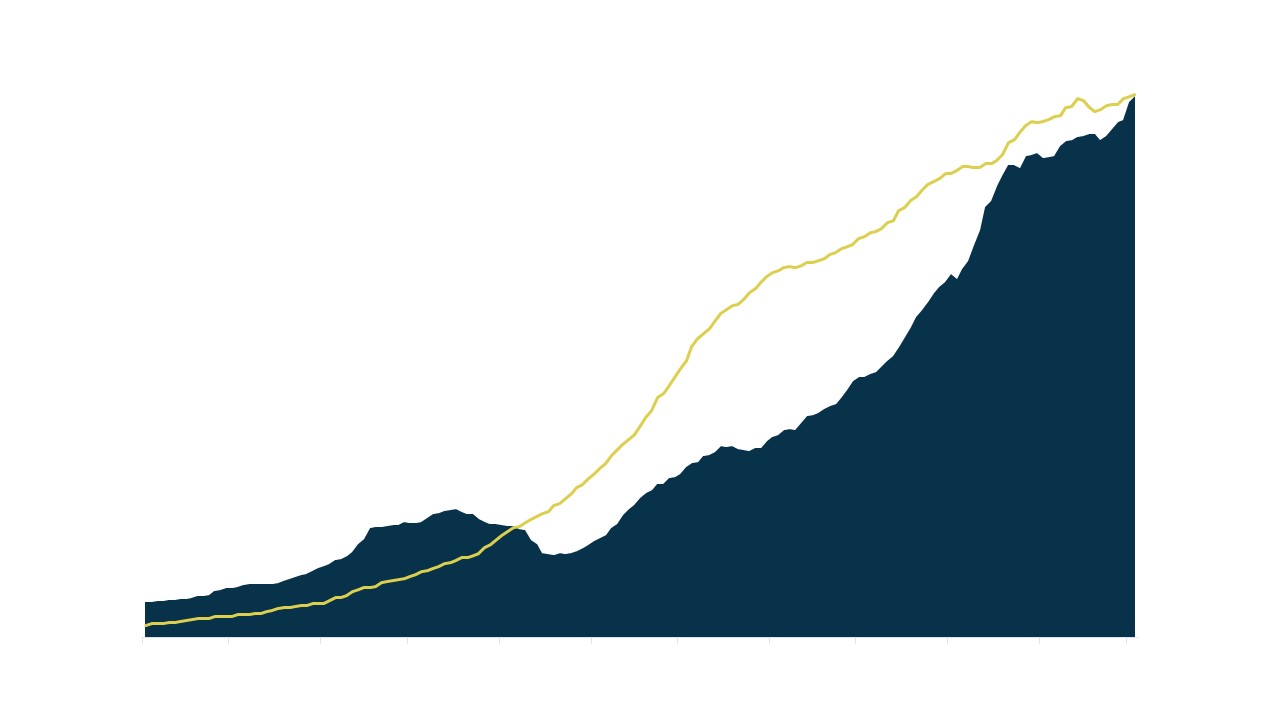

Following the capital inflows of the past month, the Alternative UCITS market continued to grow in May of 2017 to a total of 424BEUR in Assets under Management, representing a strong +8% growth since beginning of the year. Especially Fixed Income Arbitrage funds (+13BEUR) and Multi Strategy funds (+11BEUR) were popular strategies with investors.

In line with the broader Hedge Fund market, the LuxHedge Global Alternative UCITS Index posted a modest +0.11% advance in May, representing a sixth consecutive gain. Once more, performance was led by Event driven strategies as the LuxHedge Event Driven & Merger Arbitrage Index rose with +0.58% in May (+4.01% YTD). Other Equity Hedge strategies also extended their gains of the past months with Equity Long/Short Global funds advancing +0.41% (+3.50% YTD) and Equity Long/Short Europe funds gaining +0.23% in May (+2.03% YTD). The relatively small group of Equity Long/Short Asia funds continued to lead the pack with a May performance of +2.13% extending YTD gains to +12.09%.

Although returns strongly vary between different managers, Macro strategies continued to suffer on average. Global Macro funds stayed status quo during the month of May and CTA / Managed Futures funds dropped -0.67% in May, extending the YTD loss to -2.53%. Extending the negative trend since beginning of 2017, Currency Arbitrage funds continued to decline with -0.65% during May, adding up to a total loss of -3.55% YTD.