19 Jul 2017 Alternative UCITS market sees 10% asset growth and 120+ new fund launches since beginning of 2017

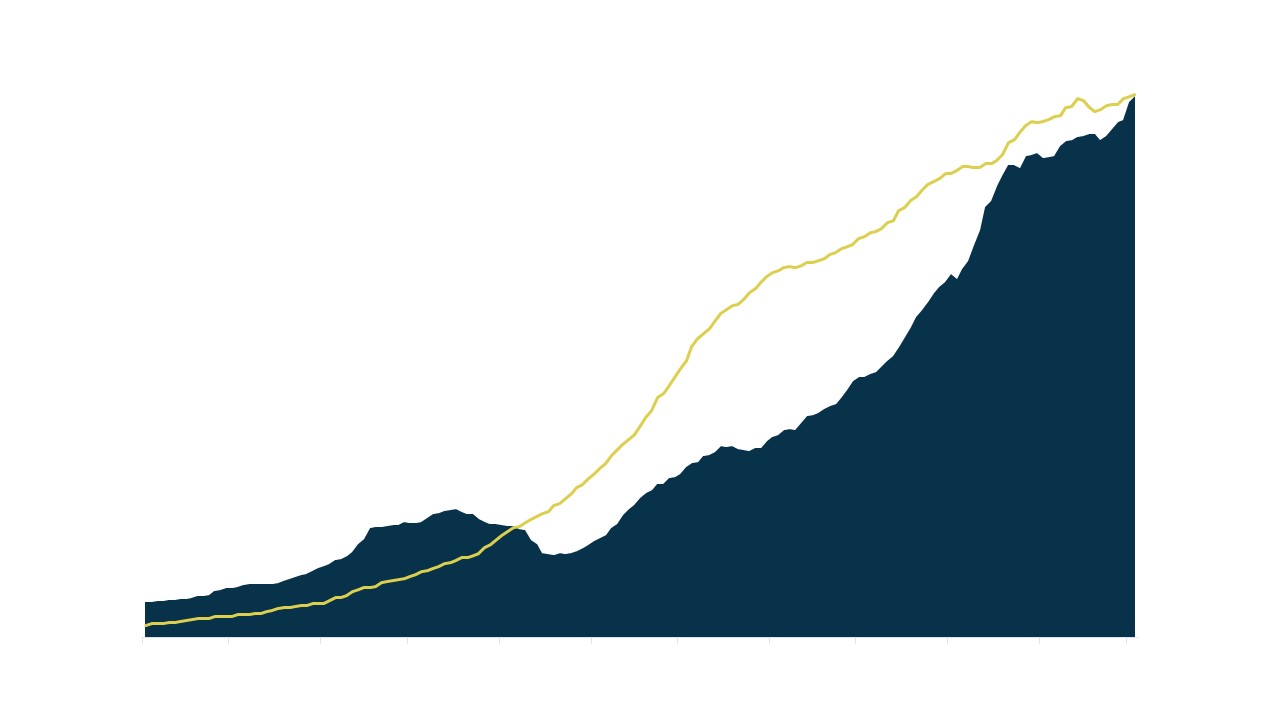

Alternative UCITS funds continued experiencing strong capital inflows during 2017 with the market reaching 435BEUR in Assets under Management by the end of June, a strong +10.2% growth since beginning of the year. The most popular alternative strategies in UCITS format were Fixed Income Arbitrage (AUM +14.7%), Global Macro (AUM +13.9%) and Multi Strategy (AUM +12.9%). Equity Long/Short funds stayed somewhat behind on this trend and recorded a +4.9% increase in assets. With the VIX index at historical lows, Volatility Arbitrage funds have lost in popularity since beginning of the year (AUM -12.6%).

Also the amount of Alternative UCITS funds keeps increasing steadily. At LuxHedge, we recorded 126 new fund launches and 79 liquidations since beginning of the year. The total LuxHedge Alternative UCITS database currently counts 1375 funds, spread over 17 alternative strategies.

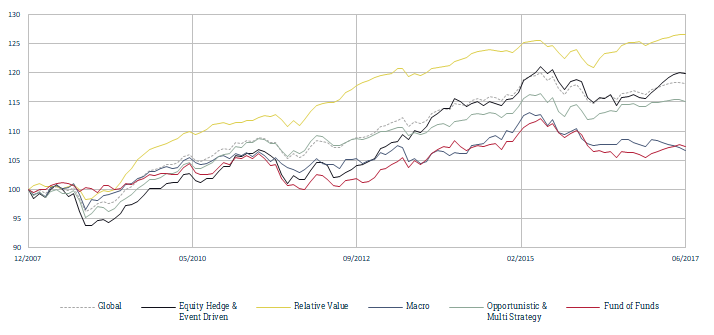

Tracking the average fund performance, the LuxHedge Global Alternative UCITS Index recorded a first monthly loss since beginning of the year: -0.25% in June (+0.78% YTD). Global Macro and Fixed Income Arbitrage UCITS funds remained relatively flat during the month of June with their respective indices advancing +0.12% and +0.02%. Also Event driven and Merger Arbitrage funds kept their ground with a +0.17% index performance in June, extending the gains since beginning of 2017 to +4.10% YTD.

Declines were recorded by Equity Hedge funds with the Equity Long/Short Europe UCITS index dropping -0.48% (YTD +1.54%) and Equity Market Neutral UCITS declining -0.11% (YTD 1.50%). Also Multi Strategy funds lost ground: -0.39% in June (+0.18% YTD). Although returns vary strongly between different managers, CTA / Managed Futures UCITS continued to suffer the largest losses on average with the CTA / Managed Futures UCITS index losing -2.01% in June (-4.49% YTD).

For further details, click here for the full June 2017 market overview