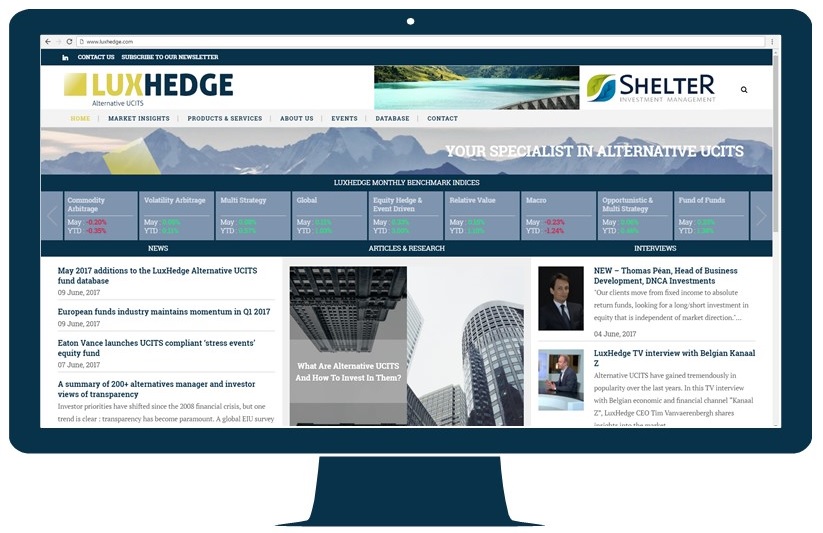

13 Jun 2017 LuxHedge launches new Alternative UCITS website with interactive database application

Alternative UCITS specialist LuxHedge is now live with its new website with an interactive application providing access to their fund database. The site covers everything from news, market insights, research articles to interviews with fund managers. It is targeted to professionals interested in Alternative UCITS funds.

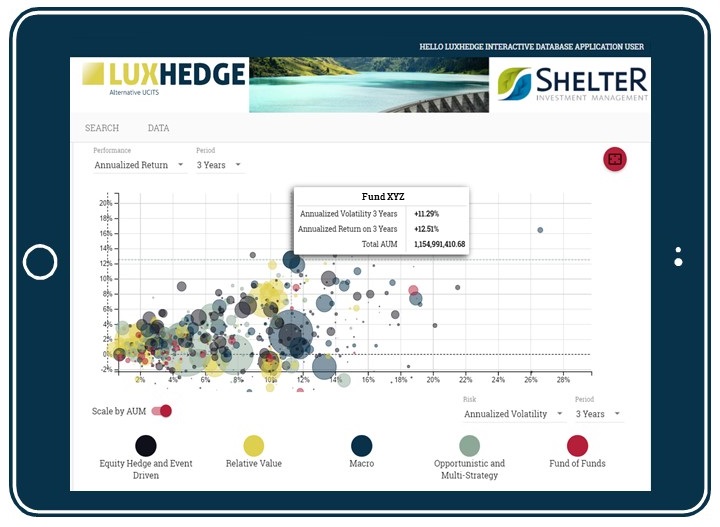

Reliable overview data on Alternative UCITS funds is hard to get by. The new LuxHedge database application is designed to bridge this gap. It’s a research tool for Alternative UCITS fund managers as it allows benchmarking and comparison and for institutional investors as it can screen on multiple parameters.

All information and research on the website is completely free of charge. The interactive database application is available as a limited free trial package and as a full access package at 160 EUR monthly subscription. Both are live as of now but note some features will be added over time.

About LuxHedge

LuxHedge is a leading marketplace for Alternative UCITS funds. It’s activities range from providing market insights, research for professional investors on quantitative fund selection research, providing benchmark indices and organizing events where fund managers and institutional clients can meet. The company is based in Luxemburg and is a subsidiary of financial group Rego Partners.

About Alternative UCITS funds

Alternative UCITS are a unique asset class, combining hedge fund alike absolute returns with the stringent regulatory oversight of the European UCITS framework. The Alternative UCITS universe has experienced double digit annual growth after the financial crisis in 2008, fueled by investors seeking diversification to their traditional portfolios but requiring liquidity, transparency, regulatory oversight and strict risk management. The LuxHedge Alternative UCITS universe currently contains over 1300 Alternative UCITS funds with total Assets Under Management exceeding 400BEUR.